Is gold a good investment? Why should I buy gold bullion? It’s natural and even prudent for an investor to wonder if a particular asset is a good investment or not. That’s especially true for gold, since it’s an inert metal and doesn’t earn any interest.

But the reasons for owning physical gold go beyond the possibility of its price rising. Gold bullion offers distinct advantages that simply can’t be found in almost any other investment. These advantages give you power as an investor. And yes, one of these reasons is because the price is poised to rise significantly (see reason #10).

To be fair, there are a few risks associated with a heavy gold investment. Dealers often charge premium fees, authenticating older coins and bars can be a challenge and the liquation spread is large. But overall, the benefits when you buy bullion far outweigh the risks, and it is an essential part of any strong portfolio.

To get these advantages, you must buy physical gold. Not paper forms like ETFs or futures contracts. These shares are nothing more than 1’s and 0’s on a computer screen, making them not much different than the fiat currency you’re hedging against. You need to buy gold bullion like coins, bars and even gold jewelry. Do this and the true advantages of investing in gold are yours.

Here the top 10 reasons why every investor should buy some gold bullion, with an emphasis on investment implications:

Gold is money

Gold is not used as money today even though it has shown its superioty in the market for over 5000 years. In fact, gold has been money more than any currency in history

Money promises to be a long term store of value and gold fulfills this promise better than any fiat currency. All government currencies have lost their purchasing power over the years when compared to gold.

Gold’s price fluctuates, but its value is timeless. Consider how gold will preserve your purchasing power over the next, say, five years compared to your currency. All paper currencies, by their very nature, lose value over time. The dollars you save in your bank or brokerage account will continue to seep purchasing power.

Investment Implication: Physical gold is one of the most ideal forms for long-term wealth preservation. It is also ideal for your heirs since it will outlast any currency they may use in the future.

Gold is a Tangible Asset

Gold is a physical metal just like the metals in your yard with obvious differences. It can be held and felt. Real gold can’t be destroyed by fire, water or even time. Unlike other commodities, gold doesn’t need feeding, fertilizer or maintenance. And since there’s only so much gold available, it has an inherent value that these other commodities don’t have.

Those that criticize gold because it doesn’t produce income misunderstand its role in a portfolio. It isn’t gold’s job to produce income; its function is as money and a store of value. This is also why gold shouldn’t be viewed as just another commodity. Gold doesn’t get “used up” like oil or corn. In fact, almost all the gold ever dug up is still in existence.

Gold cannot be hacked. It is out of reach of hackers That is one of the advantages of stocking up physical gold bullion to hedge against currency devaluation in the future.

Investment Implication: Physical gold is not subject to the risks that come with paper assets. It can’t be hacked or erased

Gold Has No Counterparty Risk

If you hold gold bullion, no paper contract is needed to make it whole. No middleman or other party is necessary to fulfill a contractual obligation. That’s because gold is the only financial asset that is not simultaneously some other entity’s liability.

This is important because gold will be the last man standing when bubbles pop or a crisis hits. That’s a powerful tool to have in your portfolio when things start to go wrong in your country or economy.

It also means gold won’t go to zero. It’s never happened in its 3,000+ year history. That’s a powerful feature, especially if you asked former shareholders of companies like Bear Stearns, Enron or Lehman Brothers.

Gold will always have value. You can always sell it if you need currency.

Investment Implication: Physical gold cannot go bankrupt or broke. Gold bullion will never default on promises or obligations.

Gold is Private and Confidential

How many assets can you say that about in today’s world? If you want a little privacy, physical gold is one of the few assets that can provide it.

Gold is one of the very few investments that can be anonymous. If you choose, no one has to know you own it. Virtually any other investment you may make does not have this benefit.

Note that you must still report any gain on your income taxes.

Investment Implication: If you want a private or confidential form of wealth, gold is one of few assets that can offer this.

Gold is Liquid and Portable

Gold is also ideal because it is easy to sell and can be carried in your pocket anywhere you go.

Gold is highly liquid. Virtually any bullion dealer in the world will recognize a Karatbar (1 gram card is called a Karatbar) and buy it from you. You can sell it to your local coin shop, a pawn shop, a private party or an online dealer. It can always be sold for cash or traded for goods.

The process is frequently quicker than selling a stock in your brokerage account. It usually takes 3 business days for settlement before cash can be transferred to your bank account or a check mailed. And other collectibles, like artwork, could take longer to sell, have a smaller customer base and would likely entail a big commission. But with gold, you can get cash or goods in hand on the spot with no hoops to jump through.

This liquidity means you can take gold with you literally anywhere in the world. And if you’re uncomfortable crossing a border with it, you can buy crypto-currency that can be easily exchanged to gold.

Investment Implication: Gold is easily convertible to cash and can go with you anywhere

Gold requires no specialized knowledge

Can you spot a real diamond? Can you look at two paintings and tell which one is the fake Van Gogh? What stamps, baseball cards and antique furniture pieces are more valuable than others?

Gold bullion requires none of this. No special skills, training or equipment are needed to buy or recognize gold bullion.

You can buy rare gold coins, but this is the world of the collector, which most investors should avoid. You’re not speculating on a numismatic coin someday fetching a higher premium than what you paid; you’re investing in gold bullion to protect you against crises and shield you from a loss in purchasing power. No rare coins are needed.

Buying gold bullion is relatively straightforward. If you’re not sure what to buy, start with this guide.

Investment Implication: No special skills or expertise is needed to buy physical gold.

Gold Can Protect Against Corrupt Politicians

You don’t have to be a conspiracy nut to understand that governments sometimes overreach. They can freeze bank accounts, garnish wages and even confiscate funds. Talk to people who were victims of these actions and they’ll tell you they had no warning.

In an economic or financial crisis, these actions increase. The government desperately needs revenue and they tend to be more aggressive in their enforcement. Or they simply pass new laws and regulations to suit their needs at the time. It has happened with virtually every government in history, and it’ll happen again, especially in a crisis situation.

There are precious few ways to protect against such actions. But one of those ways is by holding physical gold offshore.

Diversifying internationally sounds complicated, but storing some physical gold outside your home jurisdiction today is not difficult. It’s as easy as opening a bank or brokerage account. And by doing so, you buy yourself some time in a worst-case scenario. Even if you never have to use this “Plan B” money, it’s like an insurance policy against aggressive or unfair political actions. You could even someday use the proceeds of any sales to invest in other options that may not be available in your home country.

It’s a good idea to keep some of your wealth outside the banking system and also outside your political jurisdiction. Professional vault storage offers you a viable and straightforward way to do just that. It’s not a panacea, but it can put a layer between you and heavy-handed bureaucratic actions. The catch is, these preparations must be put in place before anything happens.

Investment Implication: International gold storage is simple to implement and can provide financial flexibility and investment options outside your home country

Gold Hedges Your Stock Market Investments

Want to hedge the stocks you own? Do you sometimes worry the stock market might crash?

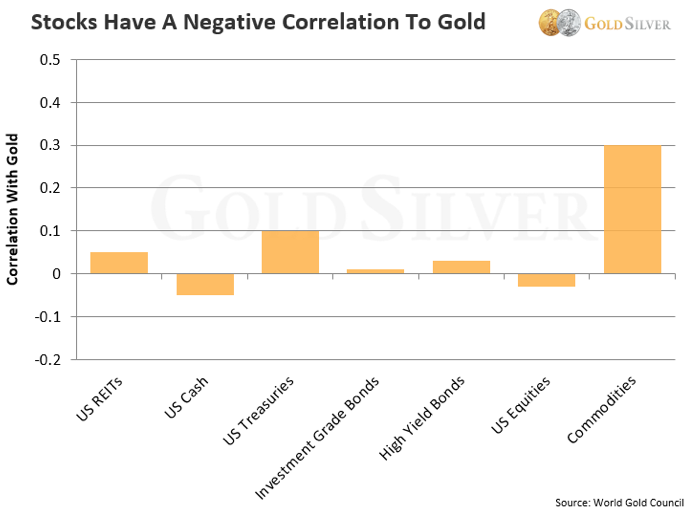

Gold may have an answer for you. This chart shows gold’s correlation to other common asset classes since 1975. The zero line means gold does the opposite of that investment half of the time. If it’s below zero gold moves in the opposite direction of that investment more often than with it (and vice versa if above zero).

The data shows that, on average, when the stock market declines, gold has historically risen more than fallen. This inverse correlation holds true even when the stock market has crashed. Check out how gold performed in the eight biggest stock market declines since 1975.

It’s true the gold price initially fell in the shock of the 2008 financial crisis. But while the S&P continued to decline, gold sharply rebounded and ended the year up 5.5 percent. Over the total 18-month stock market selloff, gold rose over 25 percent. Gold doesn’t automatically rise with every downtick in the stock market, but history shows it is sought as a safe haven in big stock market declines.

Investment Implication: If you want an asset that will rise when most financial assets fall, gold is likely to do that more often than not. The more common stocks you own, the more gold you need.

Gold Will Protect Your Portfolio in Times of Crisis

One of gold’s strongest advantages is that it can protect your investments — even your standard of living — during periods of economic, monetary or geopolitical crisis. And depending on the nature of the crisis, gold can move from a defensive tool to an offensive profit machine.

Check out how the gold price has responded to various crises

When a crisis strikes and drives fear higher — whether it’s from investors worried about the stock market or a full-blown event affecting the livelihood of all citizens — gold is a natural safe haven. Fear is what drives people in a crisis, so the greater the worry, the more gold is sought and the higher its price goes.

A lot could be written about the various crises that are possible today, but the point is that the level of risk in our economic, fiscal and monetary systems is elevated. There are so many risks, in fact, that the gold price is likely to make new all-time highs in response to some of these crises playing out.

Here’s the kind of potential gold has: the second half of the 1970s was a troubling period. It included interest rates over 15 percent, high unemployment, a 14 percent inflation rate, an energy crisis that included an oil embargo, the Soviet invasion of Afghanistan, Cold War tensions and recessions at both the beginning and end of that period. How did gold respond to all this?

From its low in August 1976 to its January 1980 high, gold rose a whopping 721 percent!

Gold is usually about defense, but in addition to its staying power, gold offers massive profit potential given the precarious nature of our economic, financial and monetary systems today. The core reason for this is due to the growing supply of fiat currencies and mounting debts around the world. This tells us that the fallout could be much worse than usual — and the greater the fallout, the higher gold will go.

Investment Implication: In a world of elevated risks on multiple fronts, gold offers lower risk, greater safety and a bigger upside than any other investment.

How many investments you know that have all these advantages?

If you want to protect your hard-earned fiat currency against devaluation through inflation, then Karatbars is the solution for you. Join this amazing company and become a part of a community that believes in the true value of gold. Register for a FREE gold savings account and immediately convert your devaluing paper currency into physical gold bullion which can be delivered to your door step by Fedex or you instruct Karatbars to store it for you at no cost.